Looking for a convenient, straightforward and flexible way of saving but not sure where to start?

If you’ve ruled out putting your hard-earned savings under your mattress, you need to find a way to make your money work for you.

A high interest online savings account is one option to consider. Whether you want to save for a new car, deposit on your first home or for that dream holiday, it’s a convenient, secure and low risk way of achieving your savings goals.

How do they work?

Unlike an everyday transaction or current account, a high interest online savings account is designed to help you save.

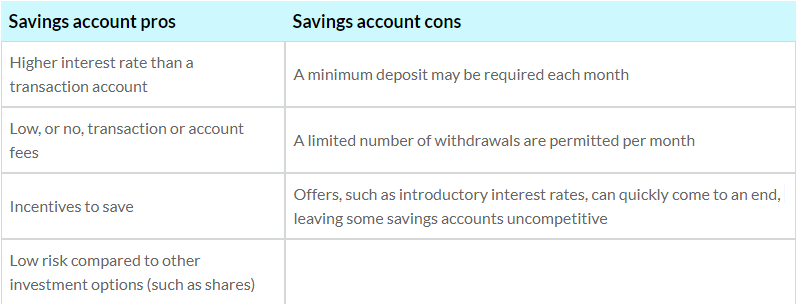

It will have a higher rate of interest than a day-to-day account and typically there are no transaction or account fees. There may be conditions placed on your account – such as how often you deposit money or can make a withdrawal. There may also be incentives, such as bonus interest, to encourage you to save. It’s a great way to accelerate compound interest – on the money you deposit as well as on the interest you have already earned.

Remember a savings account is not there for your everyday banking needs. If you want daily ATM access to your money, that’s what your regular transactional account is for.

Government guarantee on savings

Deposits up to $250,000 in authorised deposit-taking institutions (ADIs) such as your bank, building society or credit union are protected if anything happens to the ADI, such as going bankrupt. It applies to a range of accounts including savings accounts, term deposits, cash management accounts, mortgage offset accounts and your personal basic account.

There are some limits to how much protection you can expect however. A cap applies per person and per ADI. So if you have $250,000 with one ADI and $250,000 with another, then both of your deposits are guaranteed. If you have more than $250,000 with one ADI then only up to $250,000 is guaranteed.

Smart saving tips

Looking for ways to maximise your savings? Set up an automatic payment or direct debit from your current account into your savings account every month. You could also pop any bonus or other windfall in, to grow that nest egg even faster.

What to look for in a savings account

Before you sign up be sure to read the small print and get familiar with the terms and conditions of any account. Some features to look out for include:

Interest rate

Compare interest rates and check to see how long any introductory rate runs for. How often is interest paid – monthly or annually?

Minimum deposit

Some accounts require you to make a minimum deposit every month.

Linked account

Can you link your everyday account for seamless monthly contributions, and easy online access to check your balance?

Access

What are the conditions for accessing your funds? How easy is to make a withdrawal or transfer money?

Don’t forget about tax. The interest paid on your savings is considered income so is taxable. Come the end of financial year you will need an annual statement to lodge your tax return.

What about term deposit or cash management accounts?

You might also consider a term deposit or cash management account. Term deposits lock away your money for a fixed term, so are great if you think may be tempted to dip into your savings. They also guarantee you a fixed interest rate return, even if interest rates fall further. A cash management account offers access to your money, with typically tiered interest rates – the higher your balance the higher your rate of return.

Can I get better returns than a high interest savings account?

Right now, interest rates are at an all time low, which is not great for serious savers. If you want the potential for better returns than a savings account can offer and have an appetite for increased risk, consider investing in shares, property or managed funds. These do come with a very different risk profile and investment timeframes, so you will need to work out if they are right for you.

We are here to offer guidance to help you achieve your financial and life goals. Reach out to us by calling 08 82314709 or at info@centrawealth.com.au

Article reproduced from MapMyPlan