Choosing the right loan has the potential to save you thousands of dollars in repayments, fees and interest over the life of your loan.

To make an informed choice you need to understand the different types of home loans you’ll come across – before you start looking for one. There’s over a thousand available but they’re all based on two things: interest and principal.

Principal and interest loans

Most people take out a principal and interest home loan. This means you make regular payments against the principal (the amount you borrowed) as well as paying interest (how much you pay to borrow the money). This type of loan is designed to be repaid in full over the life of the loan.

A lender (also called a credit provider) will usually offer a number of different principal and interest loans, with a range of features such as a redraw facility or an offset account. Generally the more features a loan has the higher the cost will be.

The loan is usually repaid over an agreed period of time, such as 25 or 30 years. Use our mortgage calculator when you sign in for an account to give you an idea of how you can cut short the term of a loan by varying the repayments.

Interest-only

You can take out an interest-only loan which means your repayments amount only covers the interest charged on the loan. The principal amount you have borrowed doesn’t reduce unless you choose to make extra payments. Paying interest-only may cost you more over the term of the loan because you’re paying interest on a principal that doesn’t reduce.

Some people choose interest-only loans to maximise their tax benefits, or the amount they can borrow, when they buy property as an investment.

Loans are usually only interest-only for a set period of time, after which you will either need to increase your repayments to start reducing the principal, or repay the loan in full. You will need to have a clear plan on what you’ll do when the interest-only period ends.

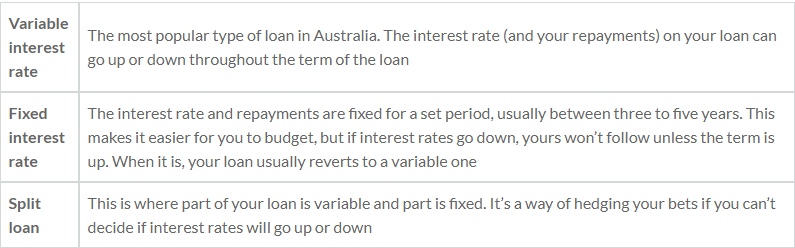

Interest rate options: variable, fixed and split rate home loans

The most common types you’ll find are:

Paying extra amounts off your mortgage will save you interest and get your loan paid off quicker but check the fine print as there may be penalties – particularly if you have a fixed rate loan.

Transaction accounts: offset accounts and redraw facilities

Offset accounts and redraw facilities both allow you to put money against the loan but a redraw facility allows you to put money straight on the loan while an offset account allows you to put money against the loan indirectly. Both types of facilities will reduce the amount of interest that you pay while only the redraw facility will actually reduce the loan amount.

If you’re a great saver you’ll benefit from either kind. If you’re not, one might suit you better than the other.

For example, a 100% offset account will probably be a more attractive option than a restrictive or expensive redraw facility if you’re intending to use the account for regular transactions.

Check out those fees!

The ongoing fees may vary depending on what services you have linked to your mortgage, such as a redraw facility, and how often you use them.

One figure you’ll see frequently on your loan statement is an administration fee which, depending on your lender is called different things and added either monthly or annually.

If you have an offset and redraw hooked up with your mortgage the fee might be around $375 per year or as little as $8 each month for a basic loan (no redraw or offset).

Some fees are actually penalties the lender will charge because you broke their rules. For example, if you want to change a fixed rate mortgage to a variable one, or repay your loan too quickly, the lender will charge a fee which isn’t generally known until they calculate it and tell you.

There is a limit on interest rates, fees and charges that a lender* who isn’t a bank for example, can charge you each year. By law, you can’t be charged more than 48% on your home loan – this includes any establishment or other fixed fees.

Conclusion

We’ve covered the basics you need to know about loans.

Understanding loans is one thing, finding a lender who’s going to support you in sickness and in health for about 25 to 30 years (the average life of a home loan) really requires some careful consideration. Perhaps more so than a marriage proposal, given the average Australian marriage currently lasts less than 10 years.

So before you say ‘I do’ to the first lender that comes along, give it some thought before you respond.

You can also arrange a convenient time to speak to Jesse Bruno, our mortgage broker at CentraMoney by clicking here.