Choosing which is better is more than an economic consideration and depends on the needs of the client.

Life insurers generally offer clients the choice to have either level or stepped premiums, or a combination on their policy. The type of insurance premium structure will affect the initial cost as well as the total cost over the lifetime of the policy.

To maximise savings, it’s important to determine first, from the beginning of the policy, how long will cover be required? The duration of the cover may help to determine the appropriate premium structure for a client to consider. Sometimes a stepped premium structure is more suitable, while at other times a level premium structure can lead to a lower cost overall.

Stepped Premiums

Stepped premiums increase as the client ages, to reflect the higher likelihood of a potential claim. Stepped premiums have lower upfront costs over the short term. However if the client continues to hold their policy, as they age, stepped premiums increase, sometimes significantly. This means the total premium cost over the lifetime of the policy can be significantly higher compared to level premiums, if held for a long period.

Level Premiums

Level premiums can provide clients with peace of mind as they are designed to remain stable. Premiums remain stable from policy commencement until the client reaches a predetermined age (e.g. level to age 55 or age 65), at which point the premium converts to a stepped premium structure. There may be increases to level premiums over time due to indexation or other increases to the sum insured. In addition, level premiums may change if the underlying assumptions and/or expenses of the insurer have changed since policy commencement. However, any premium changes will usually be made across the board – with stepped premiums changing as well.

Level premiums usually have higher upfront costs than stepped premiums at policy commencement. This is because the increased risk of claim as the insured person ages has been factored in, with premiums being averaged over a period of time.

Example

Joshua, an accountant (non-smoker), obtains $500,000 of Term Life and $300,000 Living Benefit Plus cover at age 30. The table below shows the difference in the premiums paid at age 30, 45 and 55, under a stepped and level structure.

| Age 30 | Age 45 | Age 55 | |

| Stepped premium* | $602.11 | $1,923.37 | $6,469.79 |

| Level premium to age 65* (no indexation of sum insured, policy fees or increased premiums) | $1,217.56 | $1,217.56 | $1,217.56 |

* BT Protection Plans annual premium rates as at 11 September 2018

It’s important that the correct cover and policy structure is in place at the start of the policy, as replacement policies can result in level premiums being recalculated based on the insured person’s age at the time of the amendment. Replacement policies may be required if there is a definition change (e.g. indemnity to agreed-value income protection contract) or there needs to be an ownership change (e.g. moving from a personally-owned policy to a super-owned policy).

Some policies allow clients to retain their entry age premium rates, even if they need to cancel and replace their cover at a later date.

True Level Premiums

There is also a variation to level premiums described as ‘true level’ in the industry. Under a true level premium structure, the additional premium charged each year due to indexation continues to be calculated at the age of the insured person at inception of the policy. Under a standard level premium structure, the additional premium is based on the insured person’s age when the increase occurs, which is generally more. However, standard level premiums reflect the increased risk to the insurer more accurately as the insured person ages, and is therefore more sustainable. The risk with true level premium policies is that they may be more susceptible to re-pricing in the future.

Hybrid Premiums

Some retail insurers also provide the option of a hybrid premium structure that allows the client to use stepped premiums for a portion of cover, together with level premiums for the remainder of cover. This allows the premium structure to be aligned to short-term or long-term needs within a single policy.

When Are Level Premiums More Cost Effective than Stepped Premiums?

The point at which accumulated level premiums are lower than accumulated stepped premiums depends on the actual premium payable. To properly assess this, we provide clients with comparisons. This break-even point will be affected by:

- the type of policy

- the age of the client (the break-even point is likely to be later when the client is younger)

- the age that level premiums will cease (e.g. level to age 65)

- the indexation of the sum insured

- any premium loadings due to substandard health, pastime or occupation, and

- any additional policy options that have been added to the policy.

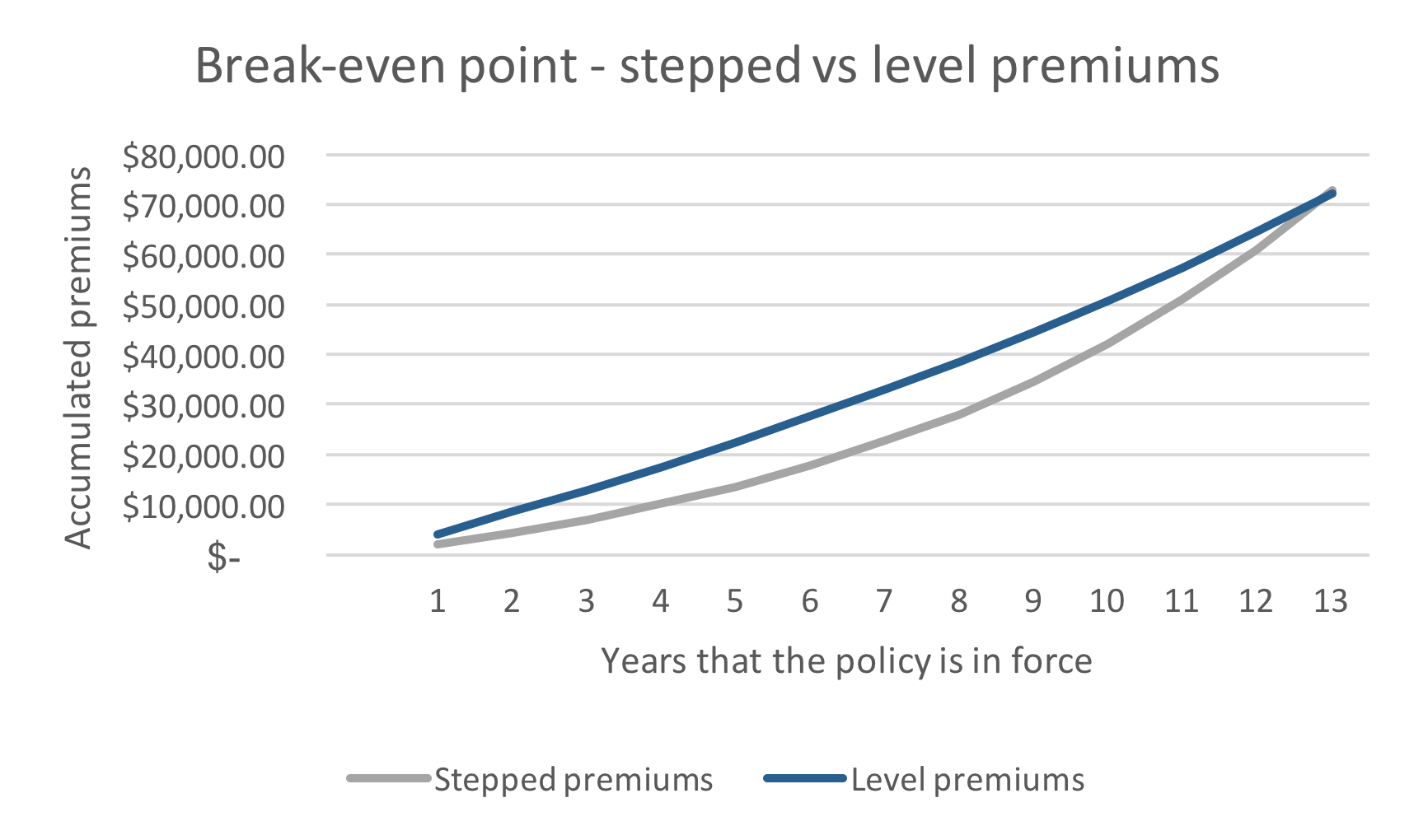

Below is an illustration that compares accumulated stepped and level premiums (to age 65) for Matthew, a 30-year-old male accountant with $500,000 indexed Term life and $300,000 Living Plus cover*.

In this example, it takes 20 years for accumulated level premiums to total less than accumulated stepped premiums.

However, if Matthew is aged 45 at commencement of the policy, it would take 13 years to reach the break-even point, as shown below*.

Generally speaking, if the client holds the insurance policy for a short period, it will be more cost-effective under a stepped premium structure. However, if the client holds the policy for the longer term, it may be more cost-effective under a level premium structure.

Generally speaking, if the client holds the insurance policy for a short period, it will be more cost-effective under a stepped premium structure. However, if the client holds the policy for the longer term, it may be more cost-effective under a level premium structure.

Locking in level premiums at commencement can give the client peace of mind, knowing that their premiums will not significantly increase over the life of their policy, unless alterations are made. Generally, the older the client is at the commencement of the policy, the sooner they will reach the break-even point between stepped and level premiums.

*BT Protection Plans annual premium rates as at 11 September 2018

*Written by Crissy DeManuele is a Senior Manager – Product Technical, Life Insurance, BT Financial Group.