Superannuation is generally intended to help fund your retirement, but there are instances where you may also be able to withdraw your super savings early, depending on your situation.

Here is a high-level summary as to when super may be accessible to you.

When you retire (and have reached your preservation age)

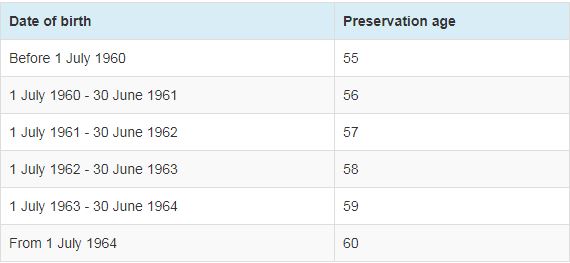

Typically, you can access your super when you’ve reached your preservation age and you retire.

Find your preservation age in the table below.

When you’re transitioning into retirement

If you’ve reached your preservation age, you might wish to access a portion of your super through a transition to retirement income stream while continuing to work full-time, part-time or casually. While this may give you some financial flexibility, there will be things to consider, including that you’ll only be able to access up to 10% of your super savings each financial year.

When you reach age 60 and stop working (but aren’t retiring)

If you’re aged 60 to 64 and stop working, even if you have no intention of retiring completely (for example, you may get another job elsewhere), you’re still considered retired for the purposes of accessing super. This means you can cash out the super you’ve accumulated up until that time even if you begin working again under a different employment arrangement.

When you reach age 65 (even if you haven’t left the workforce)

When you turn 65, you don’t have to retire or satisfy any special conditions to get full access to your super. You’re also not obligated to withdraw it, however depending on your circumstances, there may be some benefits in doing so.

Other instances where you may be able to access super

While you generally cannot take your super until retirement, there are some specific circumstances where the law allows you to draw on your super early. These mainly relate to certain medical conditions or severe financial hardship, and you must meet eligibility criteria to apply.

Compassionate grounds

You may be allowed to withdraw a certain amount of money from your super on compassionate grounds where you don’t have capacity to meet certain expenses. This may include things like certain medical-related expenses, funeral costs and mortgage repayments that will prevent you from losing your home.

Severe financial hardship

If you’re under preservation age, have been receiving financial support payments from the government for 26 weeks continuously and can’t meet reasonable and immediate family living expenses, you may be able to withdraw between $1,000 and $10,000 from your super. This can only be done once in a 12-month period.

If you’ve already reached your preservation age (plus 39 weeks), have received financial support payments from the government for a cumulative period of 39 weeks since reaching your preservation age, and are not gainfully employed on a full-time or part-time basis, there is no limit on the amount that you may be able to withdraw under severe financial hardship.

Incapacity

If you’re permanently or temporarily unable to work due to a physical or mental medical condition, you may be able to access super as a lump sum or via regular payments over a period of time.

Terminal medical condition

If you’ve been appropriately diagnosed with a terminal illness that’s likely to result in your death within a two-year period, you could apply to access your super and there are no set limits on the amount you can withdraw.

Super benefits less than $200

If you change employers and the balance of your super account is less than $200, or you have lost super that’s being held by a super fund or the Australian Taxation Office (ATO) that’s less than $200, you may be able to withdraw this money.

Leaving Australia

If you’ve worked and earned super while visiting Australia on an eligible temporary visa, you can apply to have this super paid to you as a Departing Australia Superannuation Payment (DASP), but there are requirements and documentation you may need to provide.

What to keep in mind

Depending on how much you have in super, it’s worth considering any implications of withdrawing this money, such as how the money may be taxed, and whether a withdrawal may affect Centrelink payments, such as the Age Pension.

Need help with your super? We can assist you to determine what will work best for you and start planning for the lifestyle you want in retirement. Give us a call at 08 8231 4709 or send us an email at info@centrawealth.com.au